Discover Managed Portfolios: A new way to invest tailored to your risk profile

Franklin Lacroix

Director of Investment Success

Crypto is an exciting but complex market. Navigating constant volatility, evolving narratives, and macroeconomic shifts can be overwhelming even for experienced investors. At SwissBorg, we’ve always prioritised simplifying the crypto investment journey with products like Crypto Bundles for sector-based investing, Alpha for early-stage opportunities, and Earn for DeFi yield generation.

Today, we are taking a significant leap forward in crypto wealth management with the launch of SwissBorg Managed Portfolios, a one-click, expertly managed solution designed to match your risk profile and dynamically adapt to market conditions.

What are Managed Portfolios?

SwissBorg Managed Portfolios provides a professionally managed, dynamically adjusted investment strategy. Unlike Thematics, which focuses on specific sectors but lacks downside protection, MPs are built for long-term growth with active risk management. Each portfolio has a diversified mix of assets, including Bitcoin, Altcoins, and stablecoins, with strategic rebalancing based on market conditions. Our investment team continuously optimizes portfolio allocations using two key signals:

Risk On/Off Signal: Adjusts exposure to stable assets depending on market conditions—reducing risk during downturns and increasing exposure in bullish phases.

Booster On/Off Signal: Selectively increases or limits exposure to altcoins, enhancing returns in favorable conditions and reducing risk in volatile periods.

Additionally, the SwissBorg Investment Committee meets regularly to oversee the execution of these signals and refine strategies for optimal risk-adjusted returns.

The different portfolio options

To get started with this new product, you’ll be asked to answer a set of questions that will help us at SwissBorg better understand your unique risk-reward profile and investment goals. Based on this information, you’ll be matched with one of three main portfolio options: Moderate, Growth, or Aggressive (not available). Each of those portfolios is designed for a specific risk profile. The portfolio is designed to exceed the performance of its benchmark while maintaining a comparable level of risk. This means that while aiming for higher returns, the portfolio’s risk exposure remains aligned with the benchmark's, balancing growth potential with controlled risk management.

Here, we present the backtested performance of each managed portfolio and introduce their unique investment approaches.

The performance chart is calculated using backtested data, reflecting a simulated historical performance rather than actual past results. While we strive for accuracy, backtesting relies on historical market conditions. Remembering past performance does not indicate future results , and actual returns may vary based on current and future market dynamics.

Moderate

This portfolio seeks balanced growth with moderate risk. It is a conservative option that focuses on controlled volatility and effective risk management, minimising risks while still aiming to generate consistent returns in favorable market conditions.

Who is it for? Investors seeking stability with controlled risk.

Asset Allocation: BTC, ETH, SOL, USDC.

Benchmark: 50% BTC / 50% USD.

Reallocation Frequency: Up to daily.

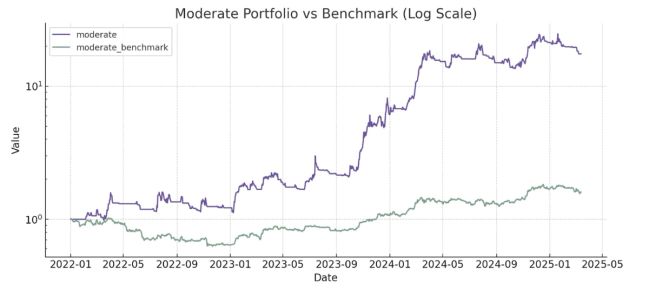

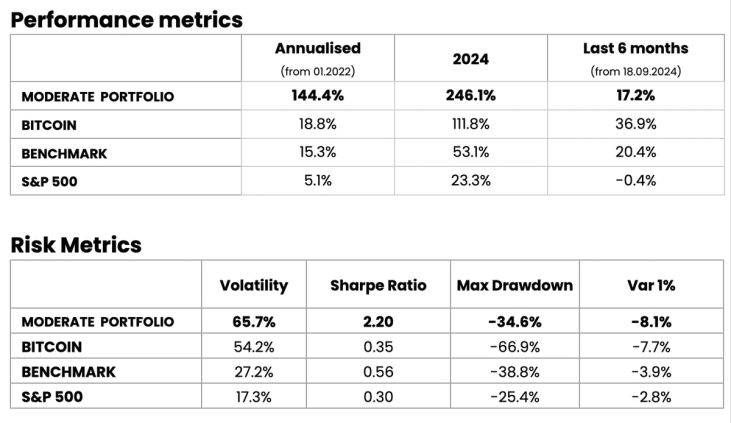

Performance chart:

Risk metrics since 1st January 2022:

Growth

This portfolio targets high returns with significant exposure to the crypto market. As a mid-risk option, it is ideal for investors with a good risk tolerance who seek capital appreciation and can withstand increased volatility.

Who is it for? Investors with a higher risk tolerance aiming for capital appreciation.

Asset Allocation: BTC, ETH, SOL, XRP, USDC.

Benchmark: 75% BTC / 25% USD.

Reallocation Frequency: Up to daily.

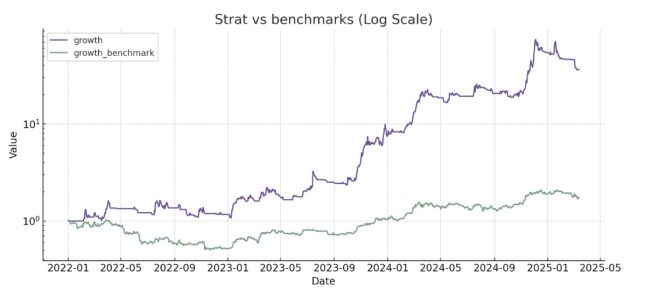

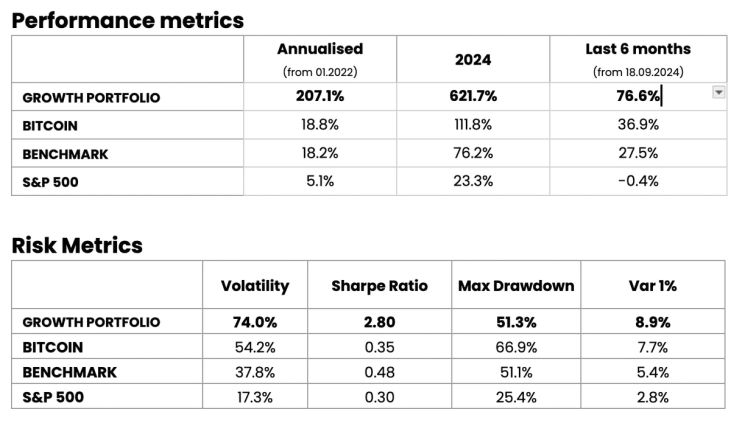

Performance chart:

Risk metrics since 1st January 2022:

Why should this be interesting for you?

The goal of Managed Portfolios is to make crypto investing more straightforward more accessible and ultimately help you on your journey to financial independence. Whether you’re an experienced crypto trader or just getting started, Managed Portfolios have something valuable to offer. Some of the key advantages include:

Easy, safe, and hassle-free

With Managed Portfolio, simplicity, and accessibility is the name of the game. There’s no need for active management; all you have to do is invest and let SwissBorg handle the complexities of portfolio construction and monitoring. If you lack expertise or don’t want to spend too much time managing your crypto portfolio, this is the ideal solution. Enjoy peace of mind knowing that your investments are being managed by experts while you focus on other priorities.

Aggressive during the bull, conservative during the bear

Rather than monitoring your investments and predicting market trends on your own, Managed Portfolios, unlike sector-specific thematics, will automatically adjust their composition according to market conditions. For instance, during a growth phase, the portfolio might include more riskier assets like BTC or altcoins, while in a downturn, the focus would shift to stable assets to protect your capital.

Transparency and simplified tracking

We know that tracking your investments easily is essential. That’s why a key focus of this new offering will be to provide complete transparency on your investment, with regular reports on performance and reallocation and personalized tracking tools to give you insight into your progress on your journey to financial independence.

Why Choose Managed Portfolios?

Managed portfolios are designed to simplify crypto investing, make it safer, and make it more profitable by removing the need for manual trading while leveraging expert-driven allocation strategies. Key benefits include:

Hands-Off Investing: No need for active management; SwissBorg handles rebalancing and portfolio optimisation.

Adaptive Market Protection: Your investments automatically shift between risk-on and risk-off assets, protecting your capital in downturns while maximising returns in bullish markets.

Transparency & Reporting: Regular performance reports, detailed reallocation insights, and personalised tracking tools keep you informed at every step.

Expert Oversight: Portfolios are managed by SwissBorg’s investment team

How to Get Started

Investing in Managed Portfolios is simple:

- Complete your investor profile assessment to determine your risk tolerance.

- Choose your portfolio based on the recommended strategy.

- Deposit funds and let SwissBorg handle the rest.

Join the Future of Crypto Wealth Management

SwissBorg Managed Portfolios offers a stress-free, high-performance alternative to self-trading. Whether you're a seasoned investor or just getting started, MPs provide a powerful way to grow your crypto wealth with expert management and automated market adaptation.

Be the first to access Managed Portfolios—sign up for early access today!

Help us shape this new product

We have worked hard on this new product and we are excited for the launch. But before moving forward, we’d love to hear your thoughts on this concept. Your feedback is essential to ensure that the product meets the real needs of you, our dear community.

Join Our Survey

By completing the survey at the end of this article, you’ll have the chance to share your preferences, specific needs, and even expectations on fees and tracking features. We’ll be carefully reviewing every response to refine our offering and possibly launch a truly innovative product aligned with your needs in crypto investing.

Thank you for helping us co-create the future of Managed Portfolios!